Switching Health Plans? How to Check Generic Drug Coverage and Save Money

10 Jan, 2026When you switch health plans, your prescription costs can jump overnight-even if you’re taking the same pills. Many people assume all generic drugs are covered the same way, but that’s not true. One plan might charge you $3 for your blood pressure med. Another might make you pay $40. And some won’t cover it at all until you’ve spent $2,000 out of pocket. The difference isn’t the drug. It’s the formulary.

What Is a Formulary, and Why Does It Matter?

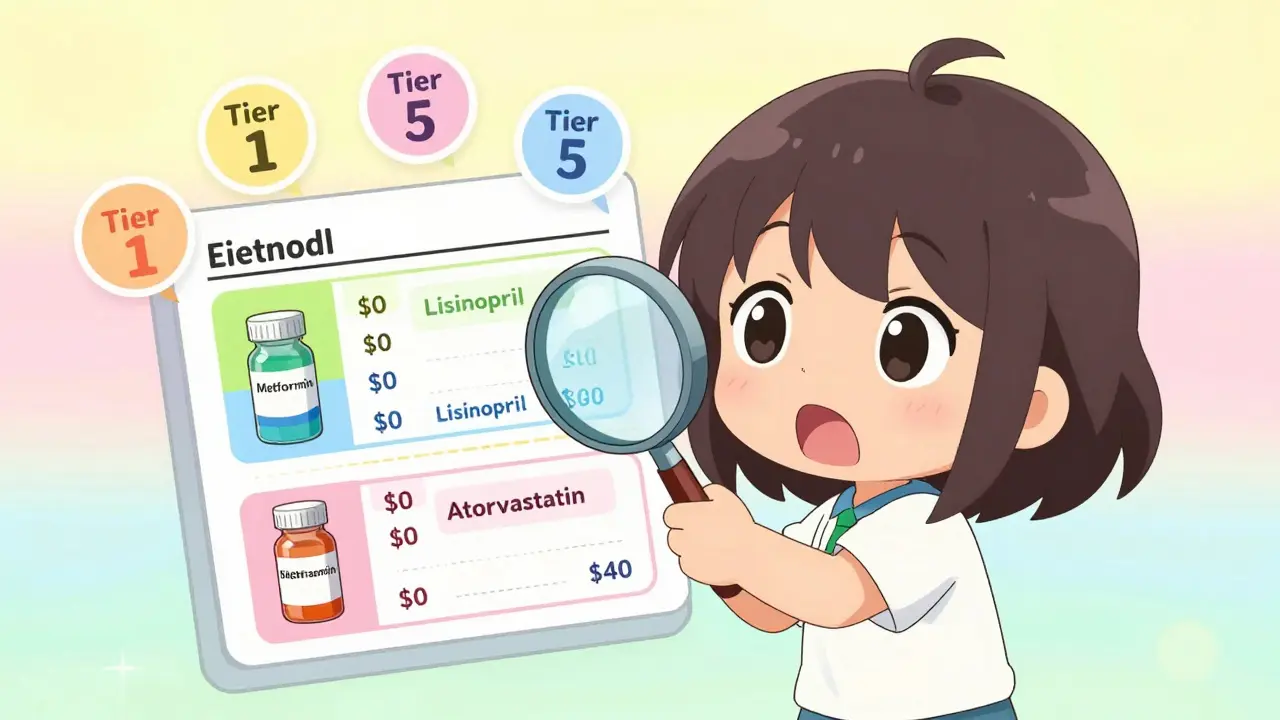

A formulary is a list of drugs your health plan covers. It’s not just a catalog. It’s a pricing map. Drugs are grouped into tiers, and each tier has a different cost to you. Tier 1 is almost always generic drugs. That’s where you save the most. But not all Tier 1 drugs are treated equally. In 2023, 92% of private health plans used a 3- to 5-tier system. Medicare Part D plans follow similar rules. The key is knowing which tier your meds are on-and whether the plan waives your deductible for generics. For example, Silver Standardized Plans on the Health Insurance Marketplace are required to waive the deductible for Tier 1 generics. That means if your plan has a $3,000 deductible, you still pay just $20 for your metformin. Other plans? You pay the full deductible first. That could cost you $1,500 extra a year if you take three or more maintenance meds.How Generic Drug Tiers Work

Most plans use one of these structures:- 3-tier: Generic ($5-$10), Preferred Brand ($30-$50), Non-Preferred Brand ($60+)

- 4-tier: Generic ($3-$20), Preferred Brand ($40), Non-Preferred Brand ($70), Specialty ($100+)

- 5-tier: Preferred Generic ($0-$10), Non-Preferred Generic ($20-$40), Preferred Brand ($50), Non-Preferred Brand ($80), Specialty ($150+)

Where Costs Really Add Up

You might think, "I only take one generic pill." But if you’re on multiple meds-say, metformin, lisinopril, and atorvastatin-that’s three prescriptions. At $20 each, that’s $240 a year. But if your plan doesn’t waive the deductible, and you hit a $1,500 deductible, you pay $1,500 before the $20 copay even kicks in. Medicare Part D plans have a $505 deductible in 2023. Most people pay $0-$10 for generics after that. But if you’re on a high-deductible health plan (HDHP) that combines medical and drug deductibles, you’re paying out of pocket for everything until you hit that combined amount. That’s a bad deal if you take regular meds. States make it even more complicated. California has an $85 separate deductible for prescriptions. New York waives deductibles for generics entirely. DC has a $350 outpatient drug deductible. If you move or switch plans across state lines, your costs can change by hundreds of dollars.

What You Must Check Before Switching

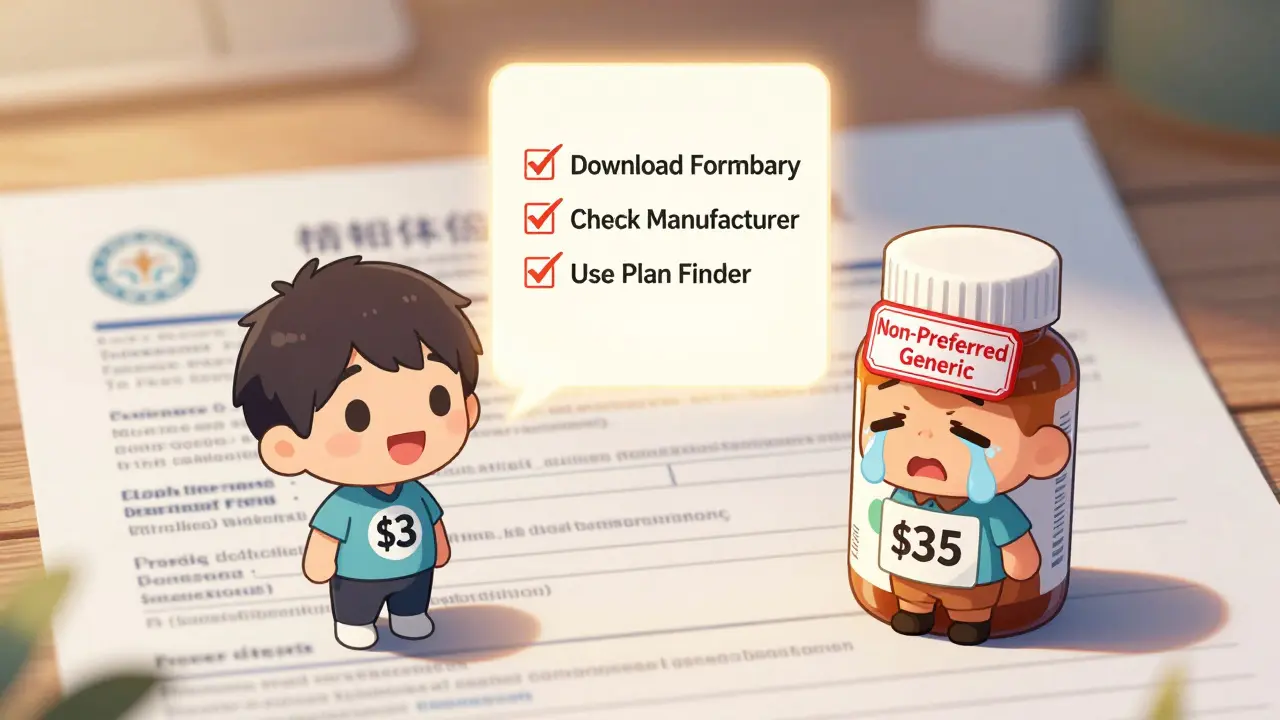

Don’t rely on the plan’s summary. Don’t trust the sales rep. Do this:- Get the full formulary. Not just the tier list. Download the complete drug list from the insurer’s website.

- Look up your exact meds. Use the brand name AND the generic name. Check the strength too-500mg metformin might be Tier 1, but 1000mg might be Tier 2.

- Check the manufacturer. If your current generic is made by Teva, but the new plan only covers Mylan, you could get hit with a surprise cost.

- Verify your pharmacy. If your local pharmacy isn’t in-network, your $3 copay becomes $75. Use the plan’s pharmacy locator.

- Calculate annual cost. Multiply your monthly copay by 12. Then add any deductible you’d have to meet first. Compare that to your current plan.

Tools That Actually Help

Use these free tools:- Medicare Plan Finder (medicare.gov/plan-compare): Enter your meds, zip code, and pharmacy. It shows exact costs across all Part D plans.

- Healthcare.gov Plan Selector: Filter plans by "prescription drug coverage" and enter your meds. It highlights Silver SPD plans that waive deductibles for generics.

- Insurer-specific formulary tools: Blue Cross, UnitedHealthcare, and others have their own search tools. They’re 96% accurate-much better than third-party sites.

Red Flags to Watch For

Watch out for these warning signs:- Your current generic is "not covered" or "requires prior authorization" in the new plan.

- The copay jumps from $5 to $20 without explanation.

- The plan says "generics are covered" but doesn’t list your specific drug.

- You’re told, "It’s the same generic," but the cost is higher.

What’s Changing in 2025

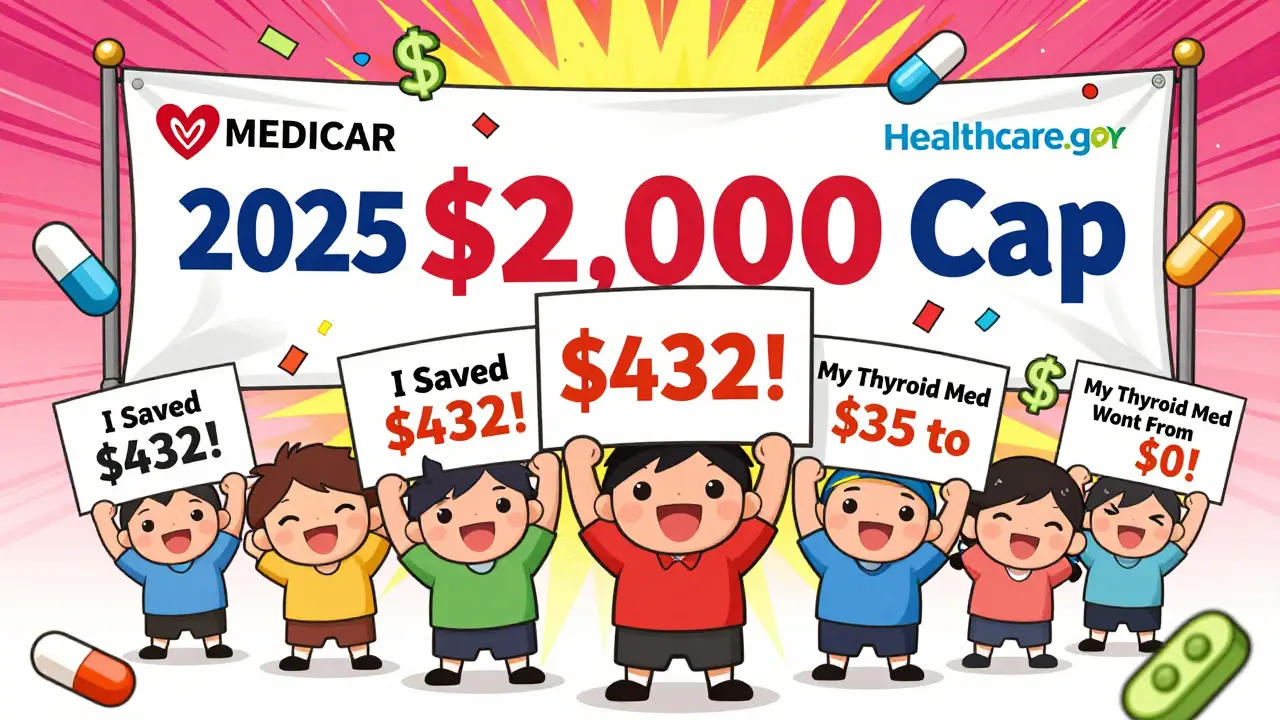

New rules are coming. The Inflation Reduction Act caps insulin at $35/month starting in 2023-and by 2025, Medicare Part D will have a $2,000 annual out-of-pocket cap for all drugs. That’s huge for people on multiple meds. Also, Medicare is splitting generics into two tiers: "Preferred" and "Non-Preferred." That means even if you’re on a generic, you might pay more if it’s not on the preferred list. And by 2027, most marketplace plans are expected to drop the combined medical/drug deductible. That’s because people kept getting hit with surprise bills. Plans are learning: if you don’t make generics affordable, people skip doses-and end up in the ER.Real Stories, Real Savings

One person in Massachusetts switched from a plan with $15 generic copays to one with $3. She took three meds. Her annual cost dropped from $540 to $108. That’s $432 saved. Another in California thought her new Medicare plan was cheaper. But her levothyroxine went from $0 to $35 because it was now a non-preferred generic. She switched back. These aren’t rare cases. Reddit’s r/healthinsurance had 147 posts in 2023 from people who got burned by a formulary change. Over half were for generic drugs.Bottom Line: Don’t Guess. Check.

Switching health plans is about more than premiums. It’s about what you pay when you need your meds. A $100-a-month plan with $40 generic copays can cost more than a $200-a-month plan with $5 copays and no deductible for generics. Take 30 minutes. List your meds. Use the Plan Finder. Download the formulary. Compare the real numbers. You don’t need a degree in insurance to do it. You just need to be careful.People who skip this step end up paying more, skipping doses, or getting hit with bills they never saw coming. Those who check? They save hundreds, sometimes thousands. And they keep taking their meds-because they can afford to.

How do I find out if my generic drug is covered by a new health plan?

Download the full formulary from the insurer’s website-don’t rely on summaries. Search for your drug by both brand and generic name, and check the exact strength (like 500mg vs. 1000mg). Look for the manufacturer too-some plans cover only certain makers. Use the Medicare Plan Finder or Healthcare.gov’s tool if you’re on a marketplace plan.

Why is my generic drug more expensive on my new plan even though it’s the same medicine?

It’s not the medicine-it’s the manufacturer. Generic drugs are made by different companies. Your plan may consider one brand (like Teva) as preferred and another (like Mylan) as non-preferred. Even though both contain the same active ingredient, the non-preferred version is placed in a higher tier, so your copay goes up. Always check the manufacturer listed on your current prescription.

Do all health plans have the same tiers for generic drugs?

No. Marketplace plans must use a 4-tier system with Tier 1 for generics, but employer plans and Medicare Advantage plans can use 3, 4, or 5 tiers. Some plans have separate deductibles for prescriptions; others combine them with your medical deductible. Silver Standardized Plans waive the deductible for Tier 1 generics-that’s a big advantage if you take regular meds.

Can I switch plans mid-year to get better generic coverage?

Usually not. You can only switch during Open Enrollment (November-December for marketplace plans, October-December for Medicare). Exceptions exist for life events like moving, losing other coverage, or if your plan drops your drug from the formulary. If your meds become unaffordable, contact your insurer or Medicare to ask about a Special Enrollment Period.

What if my plan doesn’t cover my generic drug at all?

You can request a formulary exception. Ask your doctor to submit a letter explaining why you need this specific generic-maybe because you had side effects with others. Some plans also allow you to switch to a different generic that’s covered. If all else fails, check if the manufacturer offers a patient assistance program. Many provide free or low-cost meds to those who qualify.

Cassie Widders

January 11, 2026 AT 16:31So many people don't realize their $5 pill just became $40 because the manufacturer changed. I switched plans last year and didn't check. Ended up skipping doses for months. Not worth it.

Amanda Eichstaedt

January 12, 2026 AT 20:20I live in California and was shocked when my levothyroxine went from $0 to $35. I didn't even know there was a difference between Teva and Mylan generics. Turns out my old plan had a waiver, the new one didn't. Took me three calls to Medicare to fix it. Don't trust the sales rep. Always download the full formulary. Seriously. Do it.

Alex Fortwengler

January 13, 2026 AT 16:49Big Pharma and the insurers are in cahoots. They want you to pay more even for the same damn pill. They rebrand generics as non-preferred just to squeeze cash out of you. And the government lets them. You think this is about cost control? Nah. It's about profit. They don't care if you skip your meds. You're just a number until you end up in the ER with a heart attack.

Cecelia Alta

January 13, 2026 AT 17:54Okay but let’s be real - this whole system is designed to make you feel stupid. You think you’re smart for switching plans because the premium dropped $50? Congrats, you just signed up for a $1,200 annual surprise bill because your blood pressure med is now in Tier 3. And nobody tells you. Not the website, not the rep, not even your doctor. It’s a trap. And people like me? We fall for it every year. I did it again last fall. Took me 8 weeks to figure out why my copay doubled. My pharmacist had to pull up the formulary and point it out. I cried in the parking lot. This isn’t healthcare. It’s a horror game with real consequences.

Eileen Reilly

January 14, 2026 AT 03:49so i switched to a plan that said 'generic drugs covered' and then my metformin was 'not covered' like what the actual f. i had to call 3 times and they finally said 'oh we mean the 500mg version, not the 1000mg' and i was like i’ve been taking 1000mg for 3 years. now i’m paying $45 a month for something i used to get for $5. i hate this system so much.

Lawrence Jung

January 14, 2026 AT 19:08It’s not just about tiers. It’s about power. The insurers control the formularies. The manufacturers pay them to be preferred. It’s a market rigged against the consumer. You think you’re choosing a plan? You’re just picking which corporate ladder to climb. And if your drug isn’t on the right rung? Too bad. You’re on your own.

Lelia Battle

January 14, 2026 AT 20:15I appreciate the practical advice in this post. The step-by-step checklist is exactly what people need. Many assume that because a drug is generic, it’s automatically affordable. That’s a dangerous misconception. I’ve advised several elderly patients to use the Medicare Plan Finder, and the difference in out-of-pocket costs has been life-changing. Taking 30 minutes to verify coverage isn’t just smart - it’s essential for health.

Rinky Tandon

January 16, 2026 AT 01:53THEY DO THIS ON PURPOSE. I SAW A FORMULARY THAT LISTED LEVOTHYROXINE AS NON-PREFERRED BECAUSE IT WAS MADE BY 'TEVA' - BUT THE SAME DRUG FROM 'Mylan' WAS PREFERRED. SAME CHEMISTRY. SAME FDA APPROVAL. SAME PACKAGE. BUT ONE COSTS $0. THE OTHER $35. WHO DECIDES THIS? SOMEONE WHO NEVER TOOK A PILL IN THEIR LIFE. THIS ISN’T HEALTHCARE. IT’S A GAME OF CHAOS ENGINEERED BY INSURERS TO MAKE YOU FEEL POWERLESS. AND NOW THEY WANT TO SPLIT GENERICS INTO TWO TIERS? THAT’S NOT IMPROVEMENT. THAT’S EXPLOITATION.

Ben Kono

January 16, 2026 AT 14:28My wife switched plans last year and didn't check the formulary. Her atorvastatin went from $3 to $42. She stopped taking it for three months. Got chest pain. Went to the ER. Got a $4,000 bill. The plan covered 80% of that. But she still paid $800. The $39 extra per month would’ve saved her $700. We learned the hard way. Now we check everything. Use the Plan Finder. Download the PDF. Write it down. Don’t be like us.